In any financial system, ensuring accuracy and consistency in dimension data is paramount. Dimensions are helpful in analysing the data and take decisions based on the output. Microsoft Dynamics Business Central offers maintenance of dimensions and their values so the required analysis can be done. Depending upon the nature of business dimensions in Business Central can be Business units, Employees, cost centres, Machines, Projects etc.

Dimensions can be incorrectly provided by the end users while posting the transactions and there comes a need to reverse the transaction just because the incorrect dimension was posted along with it. This can be avoided using “Dimension Correction Tool” in Microsoft Dynamics Business Central. Dimension corrections play a crucial role in maintaining these standards, but setting them up and executing them efficiently requires careful planning and execution.

In this blog post, we’ll delve into the key considerations and best practices for setting up and managing dimension corrections in your financial system.

Correcting a Dimension:

Here’s a step-by-step guide to correct dimensions:

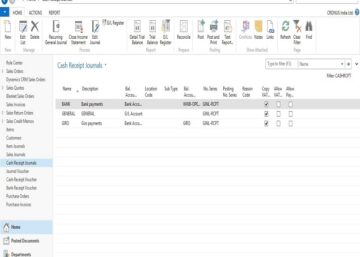

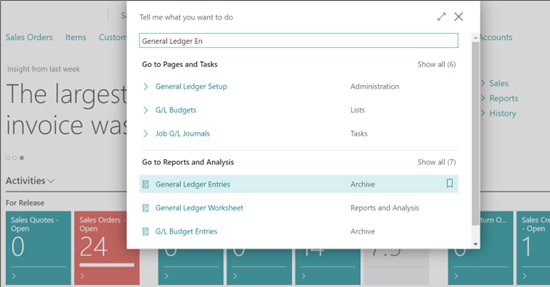

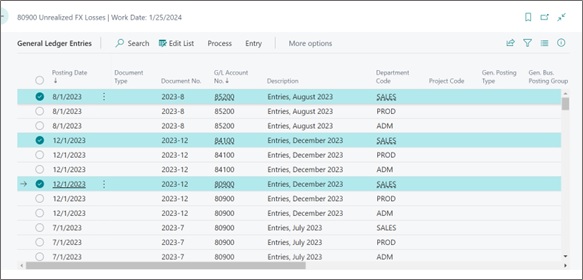

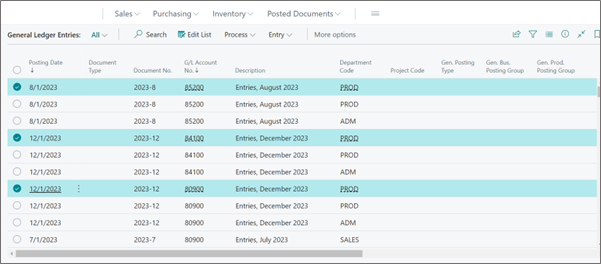

1. Navigate to the appropriate page, either the GL/Register page or the General Ledger Entries page, to initiate the correction process.

2. Manually select ledger entries or use filters to choose sets of entries for correction.

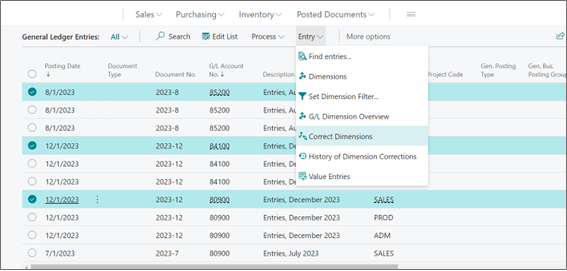

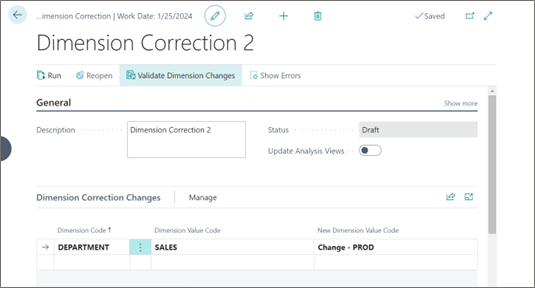

3. Select Entry -> Correct Dimensions action. The Dimension Correction page will open on the screen.

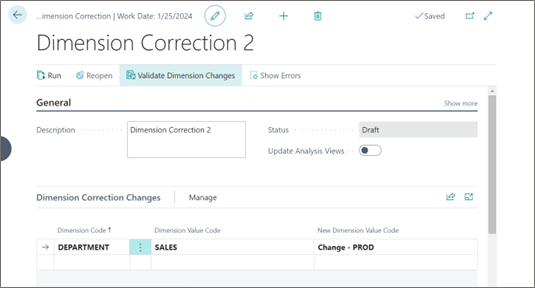

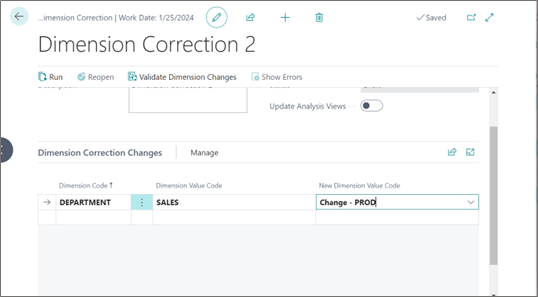

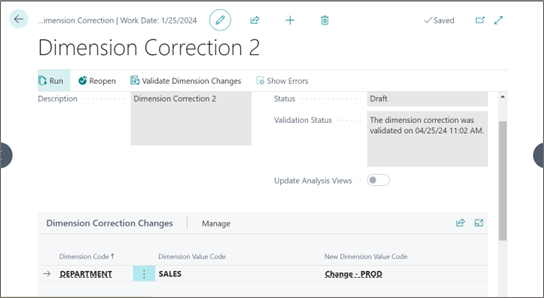

4. On the Dimension Correction Changes tab, Enter the dimension Code and the Value to be changed along with the new value.

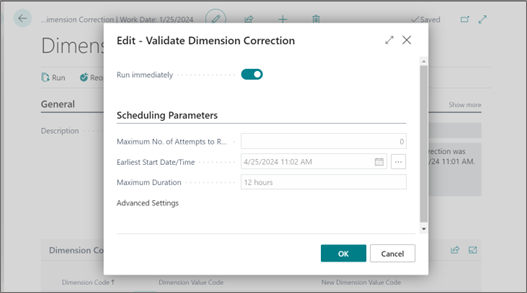

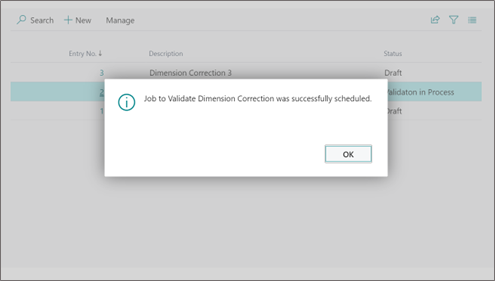

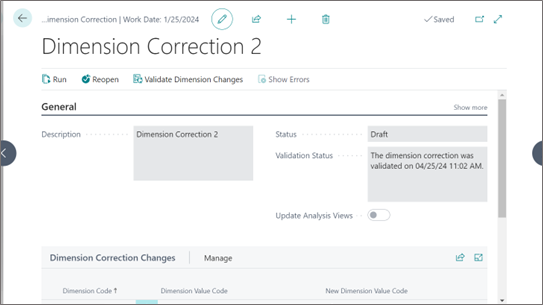

5. Validate the correction by selecting the “Validate Dimension Changes” action to check for any errors or discrepancies.

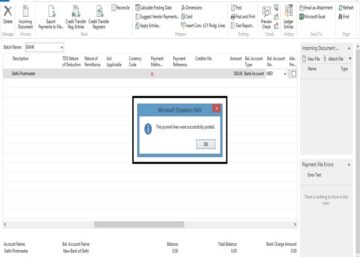

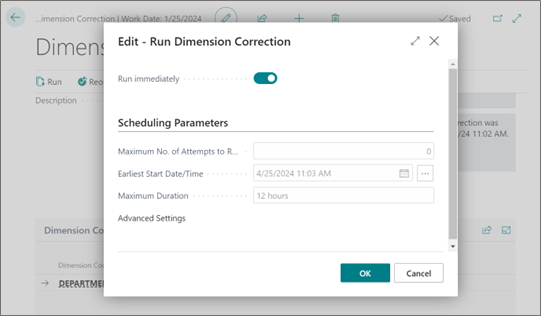

6. Once validated, execute the changes by selecting the Run action.

7. After the correction is executed, the dimensions will be corrected in the entries.

Important Points for Dimension Correction:

1. Blocking Dimension Changes:

Determine which dimensions should not be altered by specifying them on the Dimension Correction Settings page. This ensures that crucial financial data remains intact and consistent.

2. Assigning Permissions:

Decide who should have the authority to make dimension changes by granting them the D365 DIM CORRECTION permission. This permission empowers them to manage dimension corrections effectively, including specifying blocked dimensions.

3. Validation Process:

Before executing a correction, always validate it first. This ensures that any potential errors or issues are identified and addressed upfront.

4. Handling Large Data Sets:

Exercise caution when correcting large sets of entries. Utilize filters to manage corrections efficiently and consider running them outside of peak business hours to minimize disruption.

5. Utilizing Analysis Views:

Take advantage of analysis views to gain insights into dimension corrections. Enable the Update on Posting feature for real-time updates, but be mindful of the performance impact, especially with large data sets.

6. Undoing Corrections:

The Undo action allows users to revert it to draft status, allowing us to reset the changes, and providing a safety net in case of errors or changes in dimension restrictions. Additionally, historical dimension corrections can be reviewed for further analysis and audit purposes.

Conclusion:

Dimension corrections are an integral part of maintaining data integrity and accuracy in financial systems. By following best practices and using the right tools and permissions, organizations can streamline the correction process, minimize errors, and ensure compliance with regulatory requirements. With careful planning and execution, dimension corrections become a seamless and efficient aspect of financial management.