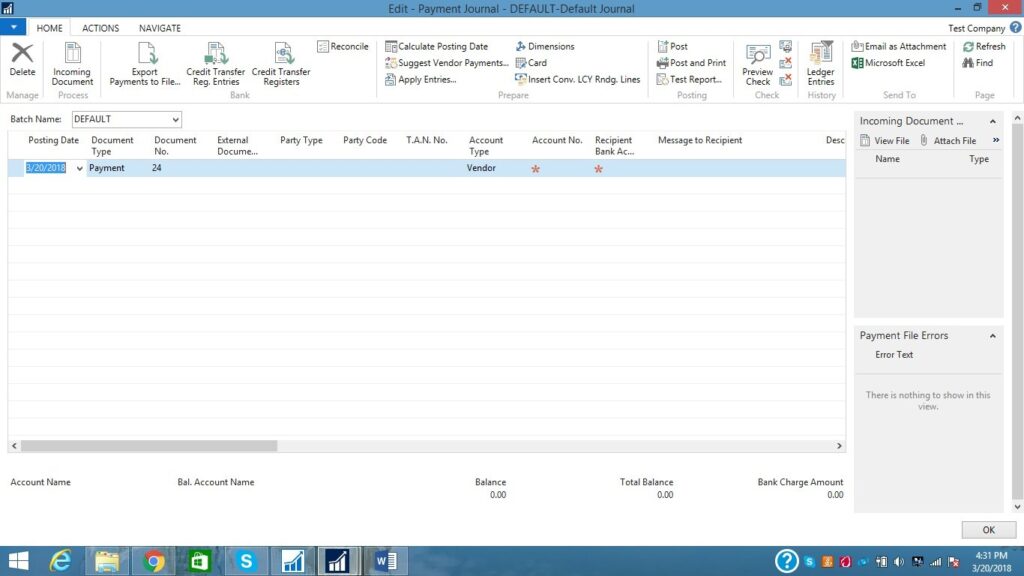

Step1:-

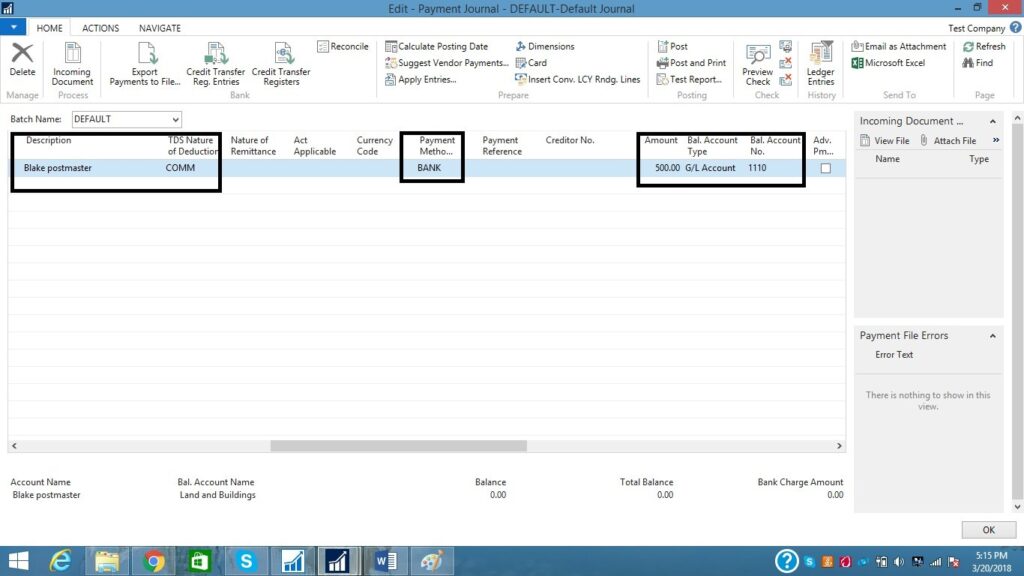

To make a TDS payment, search for payment journal and open the link.

Step2:-

Fill all the required fields i.e. posting date, document type, document no, party type, party code, T.A.N No, Account type, Account no, TDS nature of deduction, Amount, Balance Account Type, Balance Account No, Balance General Posting type.

Amount to be paid is 500.

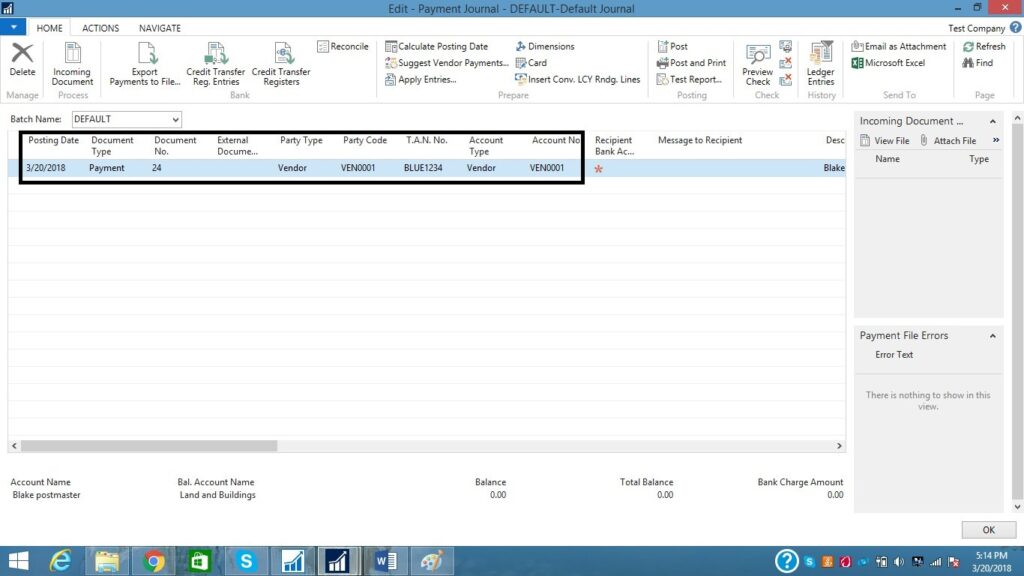

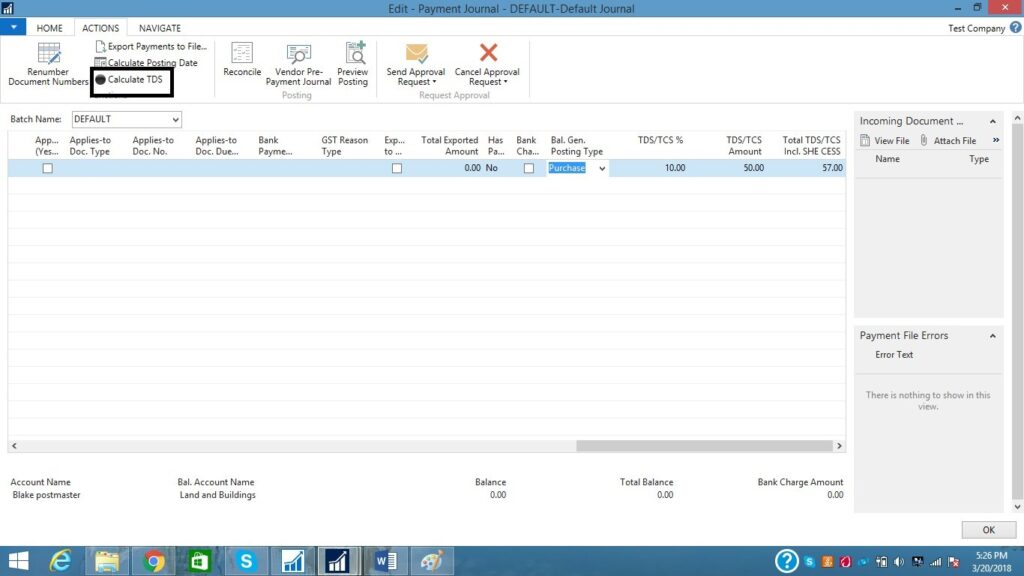

Step3:-

After filling all these fields, click on the Action button and click on “Calculate TDS”

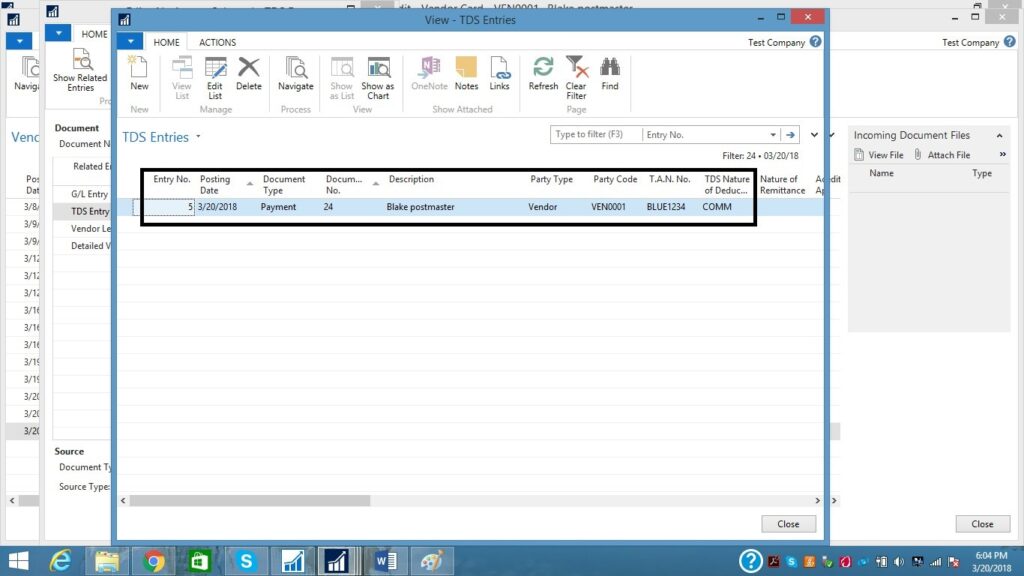

Step4:-

After calculating TDS post the general line and see the general ledger entries on vendor card

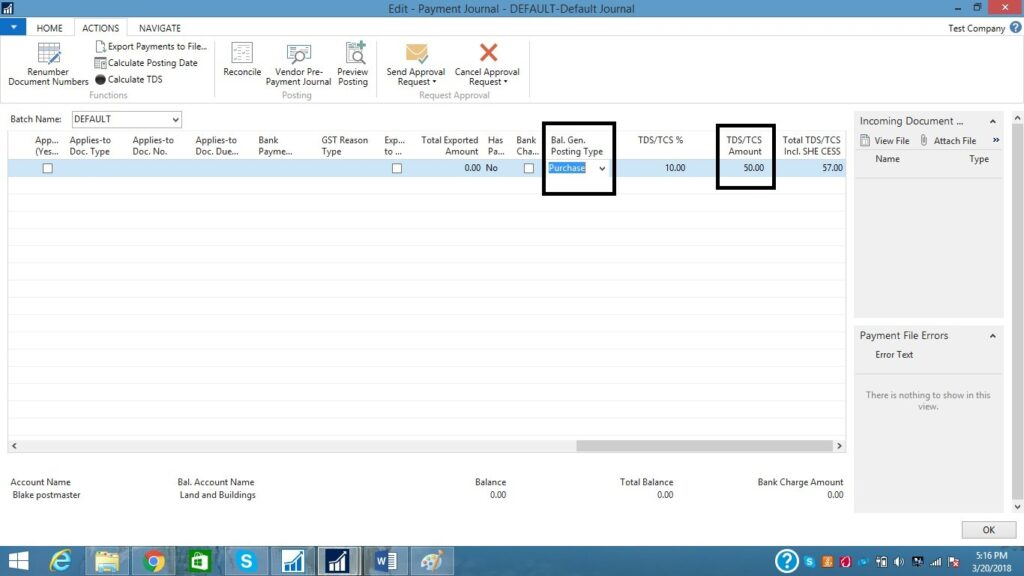

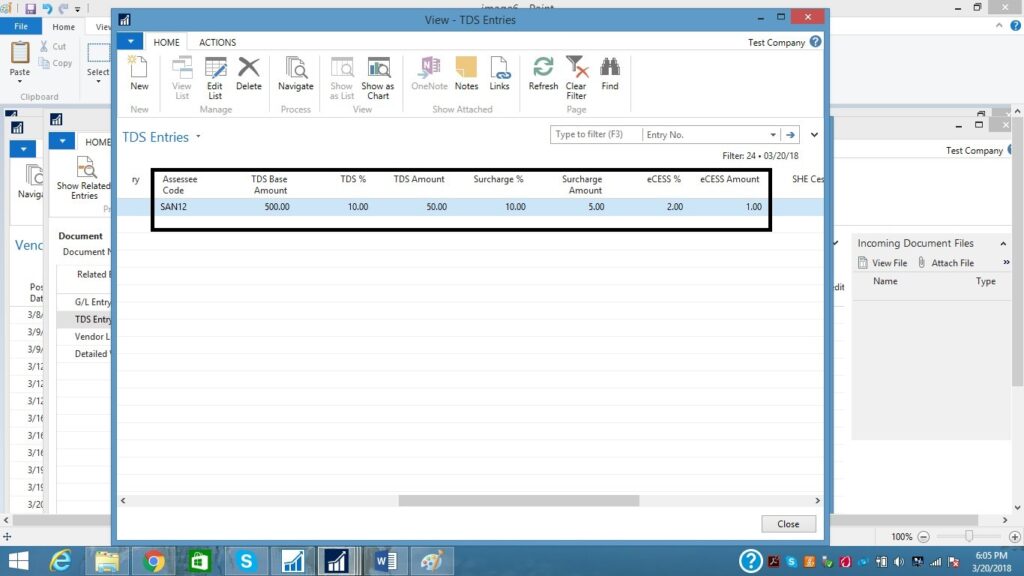

As you can see the TDS amount is 50 which is calculated by using TDS setup. In TDS setup, field name TDS% value is set as 10. Amount paid to vendor is 500.

So, 500% of 10 is 50, where 10 is TDS%.